Member Outcomes Significantly Improved by Stoneport

“The endgame” is a concept that has become commonplace when discussing DB schemes. But have Trustees been supplied with the correct tool kit to consider the most appropriate approach for their scheme, fully incorporating funding, investment and covenant risks?

The recent paper prepared by the Institute and Faculty of Actuaries’ Working Party “End States of Defined Benefits Pensions Schemes” considers this issue in detail. In particular, it raises the importance of understanding expected member outcomes when determining the appropriate target end-state (or long-term funding target) for a scheme.

Using this approach, it is easy to see the significant improvement in benefit security and member outcomes achieved by Stoneport: the risk of benefit loss for members after it completes its consolidation and becomes a fully centralised scheme is likely to be less than 1% over the remainder of Stoneport’s lifetime.

This compares to the risk for single employer schemes which ranges between 6% for those schemes with an employer covenant categorised as “strong”, using the Pensions Regulator’s covenant gradings scale, and 65% for those with a “weak” covenant according to research carried out by the PLSA, published in March 2017, using a 30 year time horizon.

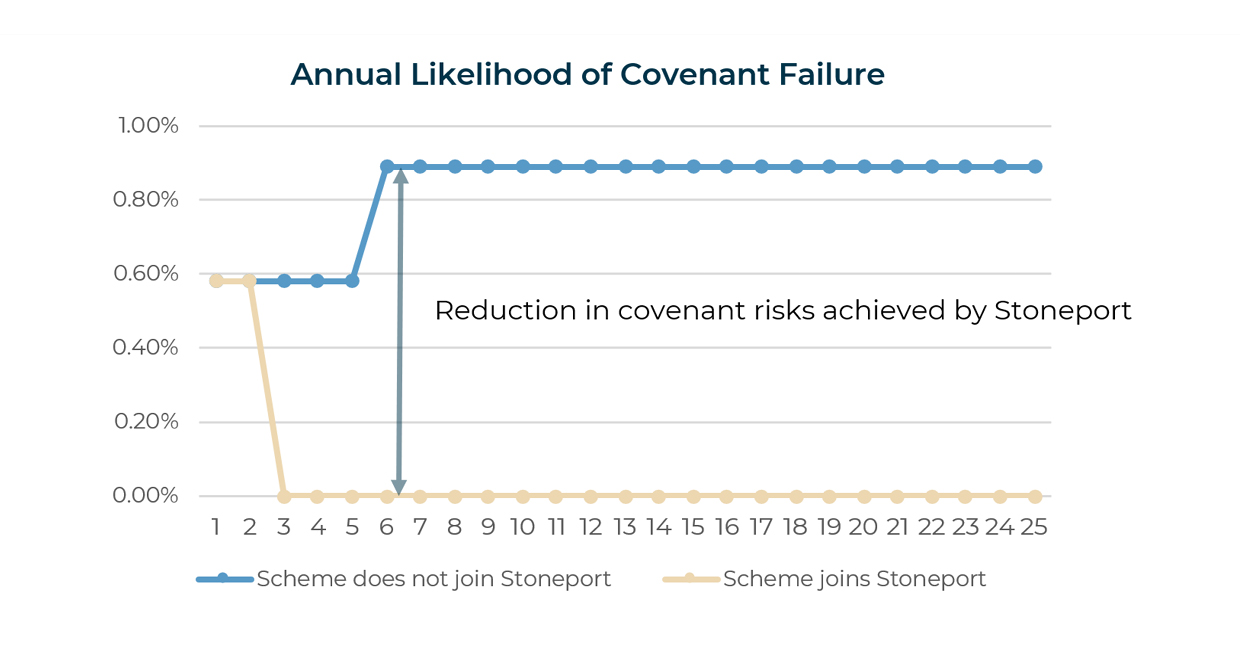

We have shown this improvement arising from Stoneport’s centralised covenant in the chart below using a similar method of presentation as the Working Party.

We assume the likelihood of insolvency of the sponsor is in line with the average for schemes likely to be eligible to join Stoneport at outset but reverts to the average for all sponsors in the defined benefit universe at the end of Year 5 (based on data available from the PPF). We consider a 25 year period reflecting the expected lifetime of Stoneport.

The annual likelihood of covenant failure should the “average” scheme decide not to join Stoneport and remain a standalone arrangement results in a cumulative risk of failure approaching 20% over the time frame considered.

In contrast, the significant reduction in covenant risks achieved by Stoneport’s centralisation virtually eliminates the likelihood of covenant failure over the remaining lifetime of Stoneport.

The covenant modelling illustrated above is just the first step in providing the kind of analysis of member outcomes advocated by the Working Party. However, the Working Party recognises that for smaller schemes, available resources will not permit sophisticated and expensive modelling of the nature set out in their paper.

As you would expect, we have carried out complex modelling and undertaken detailed consideration of the covenant risks within Stoneport and further details are available on our website. Nevertheless, the simple modelling shown above demonstrates that for the “average” scheme looking to join Stoneport the improvement to the likelihood of covenant failure, the key determinant in whether members’ benefits are paid in full, is clear. As such, Trustees should be able to quickly and easily satisfy themselves that joining Stoneport will provide superior outcomes for their members.