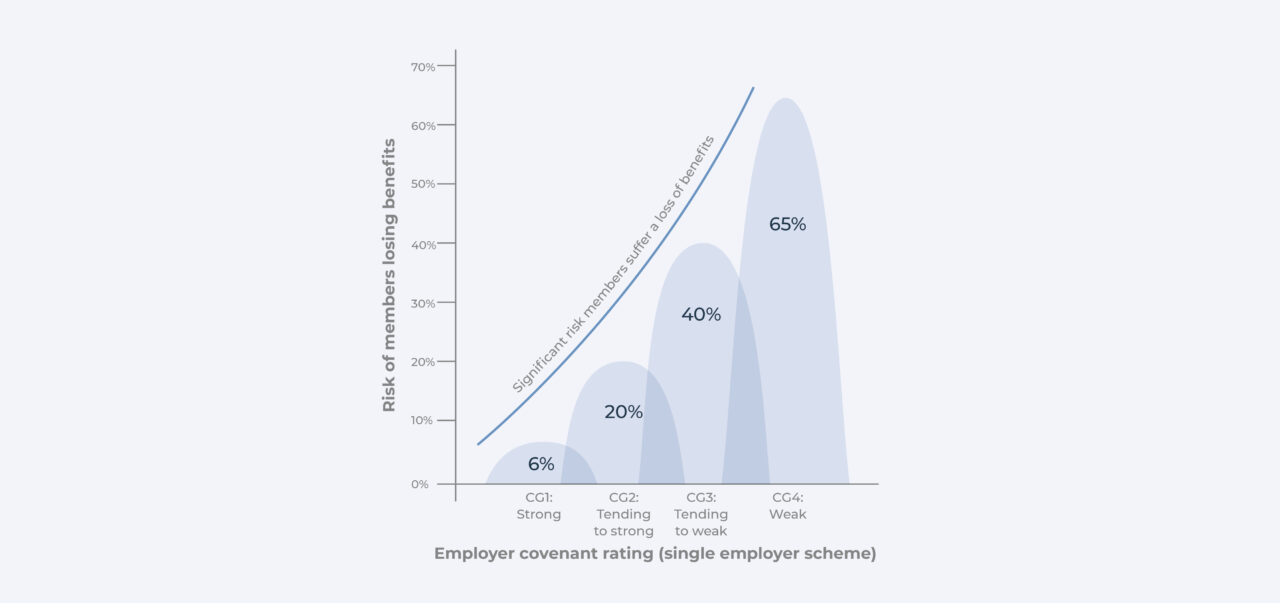

PLSA’s analysis: Risk to members’ benefits in single-employer schemes

Smaller DB schemes, those with fewer than 1,000 members each, are responsible for providing the retirement benefits of almost one million members, and those members are in turn reliant on them for a safe and secure retirement. The PLSA’s analysis, first published as part of the ‘DB Taskforce’ series in April 2016, explored this risk in detail. Their analysis showed that even schemes with the strongest employers have a 6% chance of having to reduce their members benefits, that figure rapidly increasing with reducing employer strength.

Whilst the PPF provides some protection through its compensation, members remain exposed to a material risk of loss from benefits that are not covered. Members often believe their benefits are guaranteed, when they’re not: 71% of respondents to the PLSA’s survey agreed with the statement “you are guaranteed to get the income you have been promised from a defined benefit pension”. Effective and conclusive action is required to protect members and ensure they do receive their benefits in full, as they expect. Doing nothing is simply not an option.

Stoneport is the first to provide the trustees of smaller schemes with the opportunity to take steps that will immediately and dramatically enhance the security of members’ benefits. It does this through its purpose-built structure, enabling the chances of members receiving their benefits in full to increase to a more than 99% likelihood. This, without having to pay an insurer’s buyout premium or a superfund’s entry price today, is something that will be out of reach for many.

It does this by bringing schemes together, forming one larger, stronger scheme, where risks are pooled rather than being borne individually. To find out more about how this is achieved, please take a look at our ‘Explanatory guides’ section on the Stoneport website.